Newsonomics: Inside Tronc’s Sale of the L.A. Times (And All The New Questions To Come

Patrick Soon-Shiong has finally won his hometown prize.

After a number of years of trying to buy his local paper, Los Angeles’ richest billionaire has seized an unpredictable opportunity. In a move that’s shocking but not really surprising, 65-year-old Soon-Shiong will pay a chunk of his estimated $7 billion-plus fortune to finally split with his erstwhile partner in Troncdom, chairman Michael Ferro. As I’ve reported over the last couple of years, his efforts to gain control of the Times, both public and behind the scenes, waxed and waned, but they never disappeared.

First published at Harvard’s Nieman Journalism Lab on Feb. 7, 2018

Follow Newsonomics on Twitter @kdoctor

Soon-Shiong will be on the hook for nearly $600 million. That includes the roughly $500 million sales price, first reported by The Washington Post’s Paul Farhi Tuesday afternoon, plus about $90 million in underfunded pension liabilities associated with the San Diego Union-Tribune, the other big property included in the deal. The sale keeps the L.A. Times — the largest metro newspaper in the country, in newsroom staffing, print circulation, and digital audience — in the public eye after barely a week of relative quiet.

Questions abound. What happens next? Who will actually run the Times and U-T? Will the Times aim to rejoin its once-peer companies, The New York Times and The Washington Post, in both journalistic excellence and digital business transformation? Will Soon-Shiong, even if he overpaid, reinvest at the levels that such a transformation would require? And how will new ownership deal with a newly unionized and vocal newsroom, one that cares about all those questions — not to mention where the new Times offices will be too?

With Tronc newly assertive this morning — announcing, via email from Tronc CEO Justin Dearborn, a new “Tribune Interactive” division (that’s Tribune-to-Tronc-to-Tribune for those scoring at home), headed by the just-this-morning reinstated-from-investigation Ross Levinsohn and the acquisition of a majority of BestReviews — what in fact is Ferro’s latest strategy? He’s traded his flagship L.A. Times for a big pile of cash, allowing him to substantially pay down Tronc’s debt.

But we start with the most curious question: Why now? A little less than two years ago, Ferro assumed a pose of moral outrage as Gannett attempted a hostile takeover of the company he had seized control of just months earlier.

“I believe 100 percent in my heart that this is completely a manipulation, that they’re trying to steal the company, bum-rush us,” the famously less-than-couth Ferro claimed. “It is ungentlemanly, it is not what we do in this industry. It is not the way we do business.”

Ferro beat back Gannett, the country’s largest newspaper company, and proclaimed his own desire to acquire, renaming Tribune Publishing Tronc and promising “digital transformation.” His aim: an audience of more than 100 million. Despite numerous efforts at acquisitions, he fell short, even after buying the money-losing New York Daily News. Now, by selling the Times, his grand dream appears to be cut in half. (BestReviews adds five million or less to Tronc’s audience.)

Why would Ferro willingly sell his prized flagship, his seat of Hollywood power, his Oscar ticket-enabler, the nexus of the global entertainment franchise he and his team have been planning to launch under the umbrella of the L.A. Times Network?

About 10 days ago, Ferro began spreading the word: The L.A. Times and its sibling the San Diego Union-Tribune were on the market. (The U-T has been semi-mergedoperationally with the Times since mid-2015.) Ferro and his people put out the word to the kinds of big-bucks buyers they thought might bite — both super-wealthy L.A. residents and some in publishing.

This is the same Michael Ferro who previously used his board power to expel Soon-Shiong from his vice chairman position and who had worked to make his efforts to buy the Times more difficult. So why would Ferro change directions?

Count at least four possible driving forces.

On Jan. 22, Tronc shares reached an all-time Tronc high of $20.90. That’s almost a doubling of its lowest Tronc share price, a price that had been in the $11 range as recently as May. Ferro knows that the company’s financials — generally no better than its revenue-challenged peers, financials that will get renewed attention when the company reports its 2017 full-year results later this month — don’t justify a $20 price. It’s speculation of eventual sale that has driven up the stock.

So, first off, Ferro could be doing what he has long done well in his previous pursuits: sell at a top.

January had piled headache upon headache on Tronc, as the Times melted down in full public view. Consider this succinct Tuesday tweet from L.A. Times assistant business editor Andrea Chang, as she summed up that pain:

To recap 2018 so far: @latimes unionizes. Publisher placed on leave. EIC ousted. New EIC named. Newsroom revolts against possible move to the Westside. The “Pyramid” and the “Network” uncovered. Business editor suspended, then reinstated. LAT to be sold to the richest man in L.A.

— Andrea Chang (@byandreachang) February 6, 2018

We covered all of that across five pieces here at the Lab, in all its inglorious detail.

So, second, the Times was turning to Tronc quicksand.

And then there are the whispers of what may come next. Levinsohn — the L.A. Times CEO and publisher hired by Ferro and Dearborn — has been the subject of an investigation by outside law firm Sidley Austin following an NPR story on Levinsohn’s workplace history. Today, CEO Dearborn’s memo said that Levinsohn had been “newly reinstated” and would lead the Tribune Interactive division as its CEO. Yet the whispers continue: Others in high places — the subject of new reporting efforts — might be dragged into the harassment morass, enlarging rather than containing a troublesome issue for Tronc.

So, third, maybe a sale lets the company get ahead of that story.

And, fourth, the Republican tax cut means that the profit from the sales of Tronc’s California newspapers — in 2018 — means more money in Tronc’s coffers.

Combine one, two, three and four, and Ferro’s apparent turnabout may become more explainable. But that answers only one of our questions.

After Ferro, what will the L.A. Times be?

What kind of owner will Patrick Soon-Shiong be? Those who know him well compare him favorably to Ferro. The egos may match up, but Soon-Shiong lacks Ferro’s bombast. The billionaire doctor famously keeps his own counsel, which raises the question: With so much of the Times’ top leadership gone, who runs the show — with what strategy?

In August, Tronc purged the regime of publisher/editor Davan Maharaj. In August, Levinsohn took over the top business side, bringing in his longtime executive sidekick Mickie Rosen and long-time Forbes executive Lewis D’Vorkin. None are currently doing those jobs, due to those company storms of January. Just over a week ago — as Ferro was eagerly talking up selling the Times — Tronc appointed Jim Kirk as the new editor-in-chief. Although Tronc said Kirk, a long-time Ferro favorite, wasn’t an “interim” boss, he may well now be.

But the bigger question — especially for a standalone, independent L.A. Times — is who will figure out and lead its new strategy. It’s reeling with the same revenue woes as the rest of newspaper industry, and it needs a new way forward.

Who might do that? Will the new owner bring back older hands — like Maharaj or Austin Beutner, who took his own start at transforming the Times under Tribune Publishing CEO Jack Griffin before Griffin dismissedhim? Would either want to return to the scene of so many journalistic crimes?

Might Soon-Shiong himself take an active hand? His belief in himself and his judgment — traits that got him to No. 217 on the Forbes billionaire list— might suggest that he would.

But his knowledge of publishing and of the existential challenges of the digital age is limited. Does he know what he doesn’t know?

Only two years ago, Ferro brought Soon-Shiong into the company that he’d bought effective control of for only $44.4 million. At the time, Soon-Shiong served as Ferro’s white knight; his investment of $70.5 million helped Ferro stave off the Gannett bid. At that point, Tronc made much of Soon Shiong’s Nant companies and how their technologies — which Tronc licensed triumphantly at the time but apparently never implemented — could help transform journalism.

“You’d be bringing to life whatever you see on the newspaper,” he toldBloomberg News. Every page, every picture, every commercial is merely a TV channel activated by the picture itself through machine vision recognition.”

What may be a side issue for Times readers and watchers — but not for employees — is where they will soon be relocated, given that the legendary Times building in downtown L.A. has been sold and will be refitted for condos and other development.

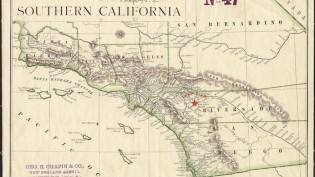

Soon-Shiong’s Nant is based in Culver City, near the LAX airport on L.A.’s Westside. As Levinsohn had begun considering Westside locations for the Times, that newly vocal newsroom had expressed objection. If Soon-Shiong becomes the Times owner, don’t be surprised if a move — a long-distance one for many in far-flung L.A — to or near the Nant headquarters moves forward.

Could the L.A. Times become The Washington Post of the west coast? Could Patrick Soon-Shiong become the Jeff Bezos of California publishing?

Sure, it’s possible, and the Times is deploying the Post’s Arc publishing system. But it’s got a long, long way to go.

What we do know about Patrick Soon-Shiong is that he’s won the trophy he most wanted. Now, beyond displaying it, what will he do with it?

Re-enter Gannett?

Is Soon-Shiong overpaying for the Times and the U-T? There’s no doubt that the ever-coy Ferro would want to get top dollar.

Given the many changes within Tronc/Tribune Publishing since Gannett came a calling in 2016 — including acquisitions, stock buybacks, and more — it’s almost impossible to compare what Gannett would have paid for the whole company. (It almost closed the deal at about $18.50 a share.) But it sure does seem like the good doctor is paying a pretty good premium for his purchase.

What we do know is that the combination of the Times and U-T generates about 50 percent of Tronc’s overall revenues and about 40 percent of its earnings. Of that share, the U-T, in the less competitive San Diego market, drives about 25 percent.

If the southern California papers are “worth” $500-$600 million, what then is the rest of Tronc worth? Its major titles include the Chicago Tribune, the Baltimore Sun, The Hartford Courant, and two big Florida papers that may prove pivotal in any next stage of Ferro deal-making, the Sun-Sentinel in Fort Lauderdale and the Orlando Sentinel.

Are those collectively worth the same amount, or more? Or did Soon-Shiong overpay to finally get his prize?

(One clue: The stock market this morning treated the sale as a huge boon to Tronc’s future, boosting its share price more than 30 percent shortly after trading opened this morning, though it’s given back some of those gains at this writing. Tronc’s entire market cap stood at $608 million at close-of-business yesterday; getting $500 million in cash and a $90 million liability off the books has impressed investors, even though the company has continued to cut its local news products.)

Perhaps it’s time for a familiar name to re-enter the drama: Gannett.

Though damaged in investors’ esteem by the failed Tronc takeover, Gannett CEO Bob Dickey would still like to grow his company. Though he was as surprised by the Ferro/Soon-Shiong deal as most observers, expect Gannett to inquire whether Ferro is now willing to sell the rest of the company as a whole or as individual titles.

Gannett holds the Chicago Tribune in particular regard, given its geographic proximity to its Milwaukee Journal Sentinel and potential for cost-saving operational synergies.

And Florida, the loose confederation’s third-largest state, may offer the most such synergy. Already, Gannett owns more Florida dailies than any other publisher, and it’s a potential buyer of the Palm Beach Post, which the Cox Media Group has put up for sale. Gannett could buy both the Post and the Sun-Sentinel and link them with its Treasure Coast titleimmediately to the north. Then, the company would dominate both the east and west coasts of Florida, as well as benefit from a statewide presence.

Is it hard to imagine Ferro and Dickey negotiating again, after their war of words two years ago? No harder than imagining Soon-Shiong and Ferro doing a deal; money heals many wounds.

Has it only been two years?

Lots of people have been involved in the soap opera that the L.A. Times has become in the past few years. It could be a movie! Maybe call it L.A. Hustle. It’s had a spell-binding run, given the cast of characters — Ferro, Griffin, Beutner, Maharaj, Dickey, Levinsohn, and D’Vorkin, among many others. Along the way, all that melodrama wounded lots of big players — and put off farther still the needed renaissance of the Los Angeles Times.

Now that’s the big prize — the big possibility — ahead.

The return of the Los Angeles Times to local (and, importantly, private) ownership could signal the most significant ownership change in the industry since Bezos’s 2013 purchase of The Washington Post.

The Times is the fourth-largest daily in the country, after The Wall Street Journal, The New York Times, and USA Today, but it has suffered mightily ever since Tribune’s old management sold control to real estate tycoon Sam Zell in 2007. Since then, the Times’ corporate parents have sown plenty of disruption of their own, on top of what the business environment has forced on them and every other American newspaper.

The Times has suffered major cuts in its newsroom staffing, and the editors and journalists who remain have struggled with uneven and often outdated strategies imposed on them. In that regard, the L.A. Times — 10 years ago regarded as a peer of its east-coast rivals — has clearly fallen behind. That’s true both journalistically — it has continued to lose prize talent to those two papers — and as a news business in digital transition.

Local ownership under Soon-Shiong could mean a pride returning to the Times. In fact, the paper’s woes go back even farther back than Sam Zell: Back in 2000, the Tribune Company bought Times-Mirror, then owned by the local L.A. Chandler family, and the Times has chafed under “Chicago control” ever since.

The critical question: Beyond staunching the bleeding of staff, which would have continued under Tronc, how and where will the new ownership reinvest? Jeff Bezos at the Post, most successfully, and John Henry at The Boston Globe have both trod this path. They took ailing enterprises private and injected new life, under a new mission-oriented strategy. That’s the possible upside for the Times, and for Los Angeles — if all the woulds and coulds recede.

This new ownership then would reset the Times (and the kind-of-orphaned Union-Tribune, which needs its own jolt of restaffing and reimagining to serve the country’s eighth-largest city) on a new path. But given the huge challenges still faced by news publishing in the age of Google/Facebook ad duopoly and ongoing digital disruption, even a billionaire has his work cut out for him.