Newsonomics: The Financialization of News Is Dimming the Lights of the Local Press

There’s a nice scene in Hail, Caesar!, the Coen brothers’ latest movie, in which one Hollywood character astutely observes: “We’re not talking about money — we’re talking about economics.”

Indeed. This year’s crazy-making U.S. presidential election further illuminates and blurs that divide. Many of my fellow Americans buy into the twin “we’re being ripped off” sentiments of Donald Trump and Bernie Sanders. The Big Short only animates the same emotions. There’s a relationship between the national anti-financial movements we’re seeing and what’s going on with our local newspapers.

Those newspapers are clearly in a state of devolution. The lights in the newsrooms are still on, but they’re dimming, noticeably. And those flickers you see? That’s the warning of the next recession, which economists now say has a 25 to 50 percent chance of happening this year.

The data points have been coming at us increasingly rapidly. What had been just a long downward slide is now getting wacky. Erratic behavior on one side of the country is quickly trumped by weirder happenings on the other, until even more befuddling news makes us forget the oddities of last month. These are all signs of a deeper reckoning than all the reckonings we’ve so far seen. And as bad as it the U.S. right now, also consider the deepening plight of our northern neighbors in Canada and the tinderbox that Europe is becoming.

Just last week came news that shocked some: London’s The Independent would cease print production and go digital-only. It’s not just the print that’s gone — it’s most of the journalists, too. As the FT reported, “The Independent’s website, which is separately owned and run, will take around 25 journalists from the print title, while it is thought up to 40 will move over to the i [The Independent’s current sister paper, which is being bought by Johnston Press]. The remainder, between 80 to 100 journalists, face the prospect of redundancy.”

Ah, the British term for buyouts and layoffs, so descriptive of the standing of journalists themselves in the great press shutdown of our time. Redundant. Unnecessary. Superfluous. Inessential. Not required. “Strict constitutionalism” sentiment is back in the air post-Scalia, but seldom are we reminded of where the founders placed the value of the free press itself: first. Those guys couldn’t have foreseen Google, autoplay video ads, or ubiquitous smartphones, but they knew the value of free-flowing news, information, and opinion in a free society.

At The Independent, it’s less of a case of management deciding than the market deciding — and management finally listening. Entering 2016, The Independent — which had as many as 400,000 daily buyers readers 20 years ago — sold 60,000 copies. Print is dying, and that’s not news — it’s just news that the news industry itself shies away from publishing, believing the nonsense that publishing the truth is a main cause of the decline. It’s not news reading that’s going away, though: that’s grown by leaps and bounds. It’s still the great digital disruption of local newspapers’ monopoly businesses that has caused the major impacts — impacts greatly exacerbated, sadly, by publishers’ own inability to reinvent themselves for the new age.

Look at the national news media (which, by the nature of the Internet, has become global news media) and we see great struggles to transition and transform. But legacy outlets from The New York Times to The Wall Street Journal to The Guardian to The Washington Post and the BBC — roughly the Digital Dozen I’ve identified — are transforming, and largely holding onto their great original news-creating ability. Most of them will make it through to the other side. That’s the 2020 of mainly digital news reading, only four years away.

It’s the local press throughout North America and Europe that should be placed on the endangered species list. We’ve just about reached the point (“The halving of America’s daily newsrooms”) where we’ll have half the number of daily journalists working as compared to 1990, when the country was somewhat smaller, less stupid about facts, and far less diverse. Analysts place the U.K. toll at at least a third. I spoke to a group of news executives from Sweden last week, who told me that there, too, the newsrooms have lost about 50 percent of their journalists.Before we connect the national anti-financial fervor to the plight of the press, let’s just highlight the state the local newspaper business is now in.

An unfortunate series of recent events

No single ownership ownership change — and there have been many — marks this era as much as casino magnate Sheldon Adelson’s secret acquisition of his hometown Las Vegas Review-Journal in December. The deal has stunk, from its initial attempt to hide the fact of Adelson as being the purchaser to early fights over what the paper could and would report on topics relating to the sale itself and Adelson’s many interests. Those interests being many — the city’s dominant gambling industry, local and national politics, and, of late, the quest to build a $1 billion public/private football stadium — editorial conflict has become a daily topic.

In the chaos of early change, numerous stories still get regular review (and changes) by Adelson and his many people, including those representing the gaming interests of his Las Vegas Sands Corp. It’s an unprecedented case of a political buyer taking over one (swing) state’s largest newspaper, believing he can bend it to his will and interests. In hiring former Gannett execs out of retirement, Adelson is now trying to put a stamp of legitimacy on the operation. I hear, though, that the owner’s efforts to influence coverage continue on, hardly abated.

And then there’s the lingering issue of “judge monitoring” that has tainted the seller in this case (Jay Rosen: “Journalists as ‘hit squad’”). GateHouse Media sold the R-J to Adelson, agreeing to the secret dodge, only a month after ordering its reporters to conduct a monitoring of Las Vegas judges. One of those judges has proven to be a particular thorn in Adelson’s backside in one of several cases involving the billionaire.

GateHouse initially said little about who ordered its three reporters to spend three weeks covering a “story” that wasn’t one — or why the work was assigned over the heads of the newspaper’s leadership. With the obvious implication that the reporting might be beneficial to Adelson — who was about to close on the sale of the paper at at a $50 million-plus profit to GateHouse — the company said little. Then, a couple of weeks ago, GateHouse CEO Mike Reed laid it out for me (“With GateHouse newspaper chain on the hot seat, CEO Mike Reed responds”) what seemed to many a bizarre conspiracy theory on the why.

Now, I’ve learned, the company is moving on to the next stage of damage control as it holds one of its first gatherings of the company’s editors in Chicago, April. 12 and 13. One key topic: What the hell happened in Las Vegas? That’s expressed as “We will discuss steps we’re taking to strengthen our news transparency codes, making sure the standards are relevant for today’s digital era” in an agenda outline sent to me Thursday by GateHouse editorial VP David Arkin. On Wednesday, GateHouse editors gathered by telephone — also an unusual event. In the hourlong call with COO Kirk Davis, the Las Vegas happenings occupied two-thirds of the time, I’m told by one of the editors on the call. This case of apparent journalistic malpractice isn’t going away quietly.

Then, last month, it was the ownership of The Philadelphia Inquirer and Daily News that took center stage, kind of. In fact, owner Gerry Lenfest diverted the spotlight from himself to a new nonprofit entity that would now become the papers’ owner (“Newsonomics: The hard realities of Philly’s Hail Mary nonprofit reorganization”). Overnight — but to a cheery Philadelphia news conference trumpeting the saving of local journalism — these two papers saw their fifth ownership change in the past 10 years. I think that’s a record, but not an enviable one.America’s sixth-largest metro area has seen its once proud — and quite distinct from one another — dailies subject to so many changes of direction that they’ve ended up in the same place, failing to make the digital transition and muttering old platitudes about inventing new ways to use new platforms to reach young readers. There should be a statute of limitations on such proclamations. In the meantime, the volume and uniqueness of Philly daily journalism has diminished year by year.

I didn’t want to, but I felt compelled to convey the skepticism requiredwhen a marginally profitable paper turns over its future to good-intentioned foundation and academic leaders. Lenfest said that the papers’ profits could be turned over to the owner to fund journalism — even as four dozen newsroom jobs were cut last fall. It’s not clear who is going to take on the papers’ likely losses in the years ahead.

Then, smack in the center of the country, the ever-interesting Tribune Publishing found a new way to make news. Last fall, it fired its L.A. Times publisher Austin Beutner, setting off a rat-a-tat-tat of L.A. civic and national journalism detonations, just as Beutner was testing out new models of community engagement as the foundation of a new business model. CEO Jack Griffin gave a short series of interviews that only worsened the company’s standing, before clamming up. As the company licked its wounds,and made some smart executive hires, it plotted how to complete its domination of the southern California market.

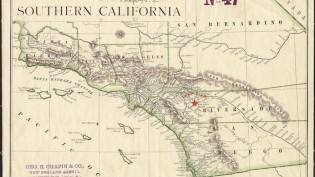

At Beutner’s urging, Tribune had bought the San Diego Union-Tribune last spring, which offered some business synergies in combination with the Times. In what the Coens would call The Big Synergy if they were doing the plotting, the next goal became the acquisition of the Orange County Register.With the Register sitting smack in the middle of San Diego and L.A., the Tribune strategy was clear: build the country’s biggest newspaper monopoly (a phrase headed toward oxymoronic status), thus adding to Tribune Publishing earnings by consolidating printing, production, distribution, and the like. While the synergies are probably overly estimated, they are real and — from a pure financial point of view — worth pursuing.

But CEO Griffin had a problem: There was no money left in the bank to buy the Register (and its sister Riverside Press-Enterprise). He’d been waiting for his opportunity to buy for more than a year, after then-CEO Aaron Kushner took the Register on a mirthless joy ride through quick expansion, quicker cutting, and leaving the coffers empty and the paper on fumes. (Griffin has suedKushner for nonpayment of fees from a pre-Tribune consulting gig, adding an odd backstory to the plot.) Remember Tribune Publishing is 18 months into life after split from mother Tribune Company, which saddled the newspaper-only TPUB with $325 million in debt while seizing its real estate and growing digital businesses (“The orphaning of the Tribune”). Tribune’s business performance has only worsened over that year and a half.It ended the year with $41 million in the bank, and no lenders willing to float the company new money to win The Big Synergy.

Enter Michael Ferro, who had led the buying of the Chicago Sun-Times four years ago and has directed it since. Ferro and Griffin — who last fall had done a deal to have the Chicago Tribune profitably do the Sun-Times’ printing and distribution (yes, if you see a pattern, such in-sourcing/out-sourcing strategies can make the difference profit and loss for many newspaper companies these days) — put together a mind-blowing new deal. Ferro would become TPUB’s new non-executive board chairman, buying 16.6 percent of new shares issued by the company. For that stake, now TPUB’s largest and one which some viewers like to say “gives him effective control” — Ferro paid in $44.4 million. (Taking a detour through Memory Lane, we can compare that to Tribune wrecker Sam Zell paying $315 million in 2007 to take over the Tribune Company, then valued at $8.2 billion. That’s well more than 10 times the value of today’s TPUB.)

The $44.4 million pot allows Tribune to bid on winning the Register out of bankruptcy (“Santa Ana showdown: Tribune’s bid for Southern California”), an auction that should end in a month. But the cost of the the money — money and economics, right? — has been a pricey one. In issuing new shares to Ferro, TPUB immediately “diluted” or devalued its existing shareholders by 20 percent. At the same time, it cut out its dividend, giving many of its income-oriented institutional investors second thoughts about holding on to what’s been a losing investment. Today, the share price, though moving up again from its bottom, has proven newly volatile after cratering.

But that volatility is minor compared to the introduction of Ferro to the august Tribune Tower headquarter of the company. As I reported last week, TPUB execs are now wondering whether they are supposed to take direction from the new “non-executive” chairman, who they see acting like a CEO, and/or from CEO Griffin. Expect bets to be laid soon on how long the Griffin/Ferro partnership will hold.

As my former boss at the Saint Paul Pioneer Press, editor Walker Lundy, would say at times like this: “You can’t make this stuff up.”

Unfortunately, those constitute only the most recent and bizarre happenings that has lost much of its dignity along with its confidence and its place in local citizens’ lives.

If you need further evidence of unsteadiness, just take a look at the fourth-quarter and year-end financials being reported by the public companies. Take Gannett, long considered the best financial manager among U.S. daily chains, as well as the largest. As reported by the ugly numbers, Gannett’s gains in digital revenue were more than cancelled out by the by-now standard weakness in print, both in circulation and advertising. Overall revenue was down 10 percent compared to 2014.

Across the industry, the public reports have come in fairly uniformly. Revenue is down in mid-single digits year over year — and you have to go back to 2007, a decade, to remember a year with any overall revenue growth. And it’s not just the U.S — nearly all the press-requiring democracies are seeing variations of the same thing. “Canada media burning” was the subject line of an email I got last week. There, Postmedia — the hugely dominant owner of dailies from B.C. to the Maritimes — isfalling apart. In the U.K., the FT’s recent exhaustive account of press decline reads almost like a necrology.

The financialization of the press

Yet I come not to bury the press tidily and be done with it. I’ll let Michael Wolff elegantly, if too simplistically, do that. In my work, I’ve tried to focus not on decline and decay, but on the building blocks of a mainly digital business model that will pay journalists fair wages to report the news for us. There’s no easily assembled formula yet, but the parts of it have become clearer over the past several years.

It is those national/global players that have begun to master new disciplines in this new age of AMP,Arc and analytics. Why? Certainly, it’s easier for them to take advantage of digital’s natural opportunities for scale. They also increasingly put data science (which leads to audience knowledge and development) at or near the centers of their business. That leads them to intelligent experimentation with the platforms of the moment (Facebook, Apple, Google, Snapchat) while local media hardly play (“As giant platforms rise, local news is getting crushed”).That leads them to think of product development as distinct from the news content itself, a change in thinking that’s still way too alien to local publishers. Finally, though, it’s what’s at the heart of their strategies that makes it all possible. What enables every one of those strategies is one constant: a good volume of high-quality original content, the kind of stuff you can’t get easily, or in volume, from many other places.

While national/global news companies have cut their newsrooms, they have still maintained sufficient capacity to make their news brands valuable in the digital age. It’s not just the numbers of journalists: It’s a good mix of veteran experienced journalists who know their beats deeply and younger journalists, still early in their careers but natively more digitally inclined.

At the local press, it’s a different picture. As newsrooms have halved, older, experienced journalists have been disproportionately made to feel redundant, and then made sent off. The main reason: money. Older journalists earn more of it, and their cutting makes short-term financial sense.

The result: a disaster whose death spiral seems to be accelerating. When I’ve given talks, I’ve gotten a lot of nods from people in the industry when I show one single slide: A two-liter bottle of Coke selling for $1 next to a one-liter bottle priced at $2. That’s essentially what local publishers have done in product and pricing of print over the last five years, doubled the price and halved the product, a halving that, of course, carries through to their digital offerings.

Any company that disrespects its own products, and those who produce them, probably deserves its eventual fate. Last week, I reported on a $1.5 million Key Executive Incentive Pool, put in place to retain seven top Orange County Register execs, through the conclusion of that bankruptcy. Now, $1.5 million among seven people isn’t an enormous amount of money, and its allocation is semi-understandable. But, as news industry leader Raju Narisetti tweeted:

Consider that many GateHouse journalists — from reporters to editors — have not gotten a single raise in five years, as is true for thousands at other companies. Newspaper CEOs, though lowly paid by many today’s CEO standards, have gotten their money (and bonuses) throughout these times — a topic that’s gotten occasional press, but now assumes more prominence in the national re-consideration of income inequality (The Big Money: “When CEO pay exploded”)

Disrespect those who produce the product, and you disrespect the product itself.

How did we end up here in 2016?

Consider the financialization of the local newspaper industry. In the chaos of The Great Recession, and its aftermath, financial players flooded in. You know many of their names: JPMorgan Chase, Angelo Gordon, Alden Global Capital, Oaktree Capital Management, and, more recently, Fortress Investments. For the most part, they blundered in, holding lots of company debt as the industry suffered a 19 percent ad revenue loss in 2009, and then oversaw at least 14 significant bankruptcies. Out of those bankruptcies (and the restructurings of companies that averted it), the financial players’ debt turned into equity. Some of the players even bought further in voluntarily; even the smart money made dumb investments in believing the bottom of the industry would be reached sooner than later.

Today, private equity companies essentially run Digital First Media and GateHouse and have unseen influence at numerous others, as restructurings have given them a greater sense of limiting what management can do with the meager cash flows coming in. Further, it’s the financial-driven perspective has led them to believe that it’s mainly cost consolidation — rather than new content-based digital product development — that must be the major strategy of the time. So far, that’s been a losing strategy for readers, journalists, and communities.

In the short-term, it’s easy to see the benefits of such strategy to the financial players. GateHouse has recently, and quickly, become the largest owner of dailies, 125, in the United States. Out of its own 2013 bankruptcy and backed with fresh Fortress funds, it’s been able to pay low prices for ailing properties coast to coast. The economics here are fairly simple: Pay no more than 3× or 4× annual company earnings, consolidate every cost you can, and keep your profit takeout steady by continuing to cut newsroom and other jobs as necessary to make The Number. If those steps weren’t enough for the Fortresses of the world, consider the additional bump from the annual “management fee” such funds put into their deals to earn their outsized profits.

One investment letter describes the arrangement succinctly last year:

New Media [the corporate holding company for GateHouse] will be externally managed by Fortress Investment Group, a large private equity/alternative investment manager with little direct expertise with media companies. Fortress is handsomely paid for this arrangement; it receives 1.5% of equity annually and 25% of adjusted profits (adding back depreciation and amortization, among other adjustments) above a 10% hurdle, so you’re essentially investing in a cheap media company with a private equity fee wrapper. The advantage of having a private equity fund manage an operating business is the capital allocation, Fortress says they have identified up to $1 billion in potential acquisition targets in the near term, which would almost quadruple the size of the company (and presumably add operating leverage along the way).

But external managers have their downsides, (1) the management fee is based on assets which essentially incentivizes them to increase the asset base irrespective of the price they pay for the assets, and (2) the incentive fee may cause the manager to take unnecessary risks as their payoff is skewed to the upside and they don’t participate equally in the downside.

That begins to answer our question as to where this is all headed, which I outlined (“Do newspaper companies have a strategy beyond milking papers for profit?”) last summer as Alden-backed Digital First Media took its papers off the market. If newspaper companies continue to lose revenue and continue to cut their content production, their products, their expertise and their ability to innovate, how many will survive by 2020?The financial guys’ answer is a blunt one: That’s not my problem. These players believe they can get in, make money, and then figure out an exit strategy in a few years.

The exits? Dropping days of print, moving into ever-smaller offices and, finally, closing the doors, as necessary. Or maybe figuring out a way to turn the remaining assets over to a nonprofit for a final tax advantage?

Is 2020 the year of reckoning? It could come later — or much earlier. If that recession strikes, the black ink of 5 to 15 percent profits will again, as they did in 2009, turn toward the red. Who will cut how much? Who will exit? What will be left standing, given how tenuous the local news industry hangs on? I hope I don’t have to update my August 2015 column (“What the next recession could do to the media business”) column too soon.

Let’s be clear here. You don’t have to join the pitchfork-clutching anti-capitalist hordes (real or a media creation?) to follow this story eagerly. It’s not capitalism that’s killing the local press; it’s the single-minded financial managing down of the enterprises that’s doing it. Nothing would be better than entrepreneurial capitalism, backed by money and a belief in a modern customer-need-filling business entering these markets. That’s what we see in the venture money that has flowed into national journalistic enterprise over the past several years, and that’s resulted in lots of news, analysis, and opinion that’s added significantly to our world view. Patch’s misguided foray and its dropping by AOL constituted one big cautionary investment in new local model; we’re still waiting for new players, with new money, to enter the picture.

Yes, money matters, but it’s that beating heart of the business — creating news that local citizens need to run their governments and better their lives — that still has to be an antidote to the single-minded financial view of local news. (If “the market” won’t support local news, many have said to me, than maybe it isn’t needed. I ask them: If the same were true of education, the arts, or even roads, where would our struggling democracy be?)

Where is the moral center of the local news industry — a moral center that long rested, if sometimes uncomfortably, alongside the demands of running a successful business? It’s talked about less frequently — fully alive in some independent newspapers (and a few handfuls of online-only news sites) and spottily among chains, some of which try (fairly quietly, so as not to raise remaining investor concern) to keep the spirit of local journalism alive.

In my talk with GateHouse CEO Mike Reed, I turned back from the judge-monitoring question to the decision that got entangled with it: the sale of Nevada’s dominant daily to someone who plainly wanted to use it for political influence. In the old, pre-digital days, when newspaper companies sold properties, they largely kept them within the brotherhood of fellow owners. They were an imperfect lot, but they subscribed to fairly common set of editorial ethics, knowing that fair and accurate reporting rode part and parcel with the ad business. So why had Reed sold to Adelson, with his public record of partisanship, his suing of reporters, and his general bullying all well publicized?

The answer was one I expected, and one that speaks to this financialization run amok.

“As a CEO of a public company, my job is to maximize returns for shareholders,” Reed said. “If I can deploy that $140 million at investment multiples we’ve been paying for properties, then I can create a tremendous amount of value for the company. We’ll be able to expand our portfolio of newspapers tremendously, so it was the right thing to do for the company and the shareholders…The more intangible factors you point out are less important.”

It’s those intangibles — let’s sum them up in one word, democracy — that now gasp for air.