A Tronc Tomorrow: The Return of Gannett and the Uberfication of News

Related column: Newsonomics: Tronc M, Tronc X, or just Tronc — it’s Still in an Uncertain Position

Time for another Tronc (Tribune Publishing) quarterly financial report. Time for more intrigue. And this time, we can ask: what kind of surprise might tronc chairman and digital media impresario Michael Ferro spring on us this time? Gannett looks like it may be resuming its quest to buy tronc’s nine newspapers. Does Ferro have something up his well-used sleeve to counter that?

Might he have an August surprise – bringing in still another new investor, or announcing a new partnership, or acquiring a small company? What might his CEO Justin Dearborn be able to talk about as Tronc moves forward in the Uberization of news, applying as rapidly as possible tech to remove the many frictions (and sometimes humans) out of news production?

First published at Politico Media

Follow Newsonomics on Twitter @kdoctor

On Wednesday, the new Tronc, renamed, rebranded, relisted and ridiculed just two months ago, releases its second-quarter earnings report. Those numbers aren’t likely to be a whole lot better than its peer companies’ reports — including the New York Times’: dismal with double-digital print-ad losses overwhelming any digital business progress.

It’s what accompanies this new set of tronc numbers that will return interest to what has only seemed like a dormant story [“The Tronc turmoil: Beyond the public quiet, pressure builds in Delaware courts, Gannett HQ and Tribune Tower itself”].

The Tronc/Michael Ferro/Gannett hostile takeover saga riveted news industry attention in the spring, as Gannett, the U.S.’s largest newspaper company, found itself confounded in its effort to buy Tribune Publishing. After a public war of words and a contest of sorts for the new Tronc board, Gannett said it would reassess its $15-a-share bid – at one point, a 99% premium over its then-share price. That reassessment, it said, would follow the release of the financials, now scheduled for Wednesday. Today, a Gannett spokesperson declined comment on a new bid.

That’s the first point of intrigue: Growing whispers of Gannett readying its next bid this week. Given that both companies – Tronc and Gannett – have competed for leverage as much in the public sphere as in the boardroom, the timing of such a bid will be one to watch. Will Gannett step on the Tronc announcement, to be released on the web after stock-market close on Wednesday and as its 5 p.m. Eastern call with financial analysts goes live? Or will it wait a day, for Tronc’s investors to absorb the revenue and profit report, swooping in with a plan to save the day? Or will it just wait further, as that still-pending case against the Tronc board and its principal officers in Delaware Chancery Court moves to resolution in Dover?

Tronc investors clearly expect another bid. TRNC, now moved to the NASDAQ from the NYSE, closed at $14.87 today, just below Gannett’s last offer. We’ve known that Gannett would move beyond that last $15-a-share price in its third bid (having started at $12.25, on April 25). The questions have been: How much and when? While Gannett CEO Bob Dickey, in his own second-quarter conference call (on his own subpar financials) didn’t speak directly of his pursuit of the Elusive Tronc, he did reiterate the company’s aim to add “15 to 30” new daily properties over “the next several years.” Tronc offers nine markets, seven of them metropolitan ones.

If a bid comes this week, expect it to be in the $18-20 range.

Yet, even such a been-there-seen-that offer requires defense. So far, Ferro’s best has been serial offense. Ferro needs to provide his CEO, Justin Dearborn, with a good story to tell on Wednesday, just as he did just a quarter ago. Spending little time on the then-Gannett bid, Dearborn then laid out the Tronc big picture, that AI machine-learning-driven strategy that has now guided the near-complete restructuring of the company, in its name and in its leadership. Then, as Gannett returned with its second bid, Ferro pulled the Patrick Soon-Shiong rabbit from his hat, announcing the L.A. billionaire’s $70.5 million investment in the company.

Announcing a further extension of that AI-driven news future may well be that next trick. As I noted two weeks ago, Ferro has talked about buying a user-generated content company, as well as expanding the numerous partnerships is developing.

One of those companies that has drawn his interest is Fresco News, I’ve learned from several sources. A two-year-old, New York City-based, venture-funded startup, Fresco News focuses on video, in theory, producing a lot of content cheaply. Its aim: “to turn bystanders into citizen journalists.” Its message to would-be contributors, fronting its website: “The world needs your camera.”

Inside Tronc, Ferro has talked about the promise of Fresco News – lots of low-cost video content that can be monetized with advertising – and how well it fits with several of the other known Tronc initiatives. Tronc now works with video producers like Wochit and widget producers like SNT Media [”Welcome to the Tronc widgeteria”]. National consolidation of local website management – and reduction of local newspaper digital staff positions – parallels that embrace of nationally produced, tech-driven content, a number of confidential sources tell me.

Is Tronc close to acquiring Fresco News, or might it simply announce a partnership with the company soon? Is Fresco News indeed for sale? Tronc declined comment on a possible acquisition and Fresco News CEO John Meyer didn’t respond to requests for comment on his company or its closeness to be sold.

Tronc isn’t alone in seeing the value of user-generated video news content. The kinds of abilities that Fresco offers are now increasingly sought by media companies globally.

Given the spate of live news events captured by civilian smartphones, there’s been a recent small boom in user-generated platforms. Stringr, NewZulu, Bambuser and SAM Inc. all ply differing parts of the territory, along with Fresco News. Media companies look to these tech companies to deal with the complexities of assignment, gathering, vetting and media company workflow.

Fresco News’s technology removes much of the “friction” in getting amateur-shot newsy video, through the process from the camcorder to a website or local TV news program. Smoothing that path means routinizing everything from uploading to image enhancement to tagging and distributing.

The Uberfication idea here: take all the complexity of that old world and tame it through an app. John Meyer, now 21, dropped out of NYU two years ago, to start the company. Says one visitor to Fresco’s downtown New York office, “he’s straight out of Silicon Valley central casting,” in other words, the image of a brilliant, brash digital entrepreneur.

It is in the local TV business that Fresco News has found its first commercial niche. In March [Techcrunch: “Fresco News teams with Fox to bring citizen journalism to local newsrooms around the U.S.”], Fresco News announced its first big deal, after testing its app numerous news organizations, including The Associated Press, Media General and Calkins Media. Now contracted with 21st Century Fox and working with eleven of its metro TV operations, Fox has itself become more impressed with Fresco News’s low-cost video-making. It, too, sources say, actively considers buying the company. 21st Century Fox declined to comment on a possible acquisition.

Fresco News doesn’t yet have much to show in revenues or profits for its seed round venture investors, who include CNN co-founder Reese Schonfeld, MediaBistro founder Laurel Touby, former Yahoo executive Ross Levinsohn, and former NewsCorp/AOL exec Jonathan Miller. They’ve put $1.4 million into the company so far.

While Fresco News aims to work with local TV and newspaper companies, the higher end of the user-gen video business has been well-developed by Storyful. Storyful’s client list of 80 includes top news brands (ABC News, NY Times, Wall Street Journal, Vice, Sky News) and bigger corporate clients, including Heineken, Toyota and Google. That acceptance speaks to the trust that its video licensing and vetting-for-authenticity business has engendered over time.

Two years ago, News Corp. – the newspaper-centric company split off from 21st Century Fox – bought Storyful.

Those who have looked at Fresco News up close credit it with a good user interface, but question the depth of its journalistic chops – that crucial ability to vet amateur-shot video for credibility.

We can see the Fresco model gestating at the Fox TV stations. What Fox – along with the rest of the legacy content-producing media — wants to do is reduce costs. Can it replace highly paid professional videographers with on-demand video takers? Can it do so in sufficient numbers to reduce its headcount?

Fresco News aims, in part, to mobilize “stay-at-home” moms, who can respond to a pin dropped on a Google map offering assignments. Get there first, get some video and amateur photographers and videographers may get paid $20-50, while local media organizations pay twice or more per photo or video; Fresco News takes about a 30% revenue share for its role as a friction-busting tech middleman.

In addition to the pin-dropping assignments that video-takers can receive via the TV stations, anyone with a camera can sign up via the Fresco News app and begin immediately submitted material.

Much of the 50-person Fresco News staff is content-oriented. That staff both reviews station assignments and community-generated video.

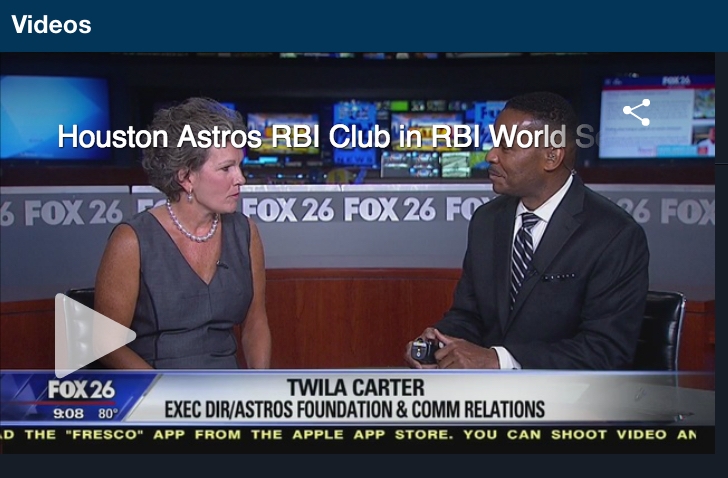

Fox TV news directors have publicly praised it as a good supplement to their news gathering. In Houston, as much a third to a quarter of the local Fox station’s recent storm-related video was driven by Fresco News, says Ashley Seashore, whose Arrow Public Relations does communications for Fresco. Stations also pitch their publics, via their own websites, on the new Fresco News opportunity, as seen in the crawl of the Fox Houston station above.

User-generated content was once hailed as the replacement journalism of the 21st century. While UGC has found lots of niches on the web, it hasn’t done much to replace all the lost professional local reporting. That loss now totals half the number of journalists who had worked in daily newspapers in 1990, with about 27,000 still remaining.

Interestingly, the new popularity of UGC video makes sense. First, it produces highly sought “video,” whose ad inventory still out-sells traditional display by three-to-one or more in price. Second, video doesn’t require an editorial voice as much as writing. Professional videographers — whose jobs would be threatened with mass adoption of a Fresco News-like model – certainly bring layers of journalistic judgment to their craft. As with all journalists, though, that judgment now has a number assigned to it, and in the math, their jobs have become more precarious.

What should the market make of the Tronc strategy? Many in the business separate out the potential value of the Wochits, the SNTs and the Fresco News from the outsized promises of Tronc’s leadership. Clearly, these streamlining, cost-saving technologies – well-executed – make sense. Clearly, technologies like these will become part of all digital media futures. Yet, their impact – so far and into the known future – is incremental. They effect some cost savings here, and help generate a little extra revenue there, but in today’s market, they are far from game-changing.

For Michael Ferro – a true believer in technology as a solver of business woe – such gambits offer a twofer. The tech, he believes, will change the nature of publishing; and besides, still another well-timed act of partnership, or acquisition, will reassure the market that his much-maligned strategy has a basis in business reality. That’s why, in addition to his talk of a Fresco News deal, he’s talked with associates about buying other, bigger companies. Where would he get the money, one savvy news executive wondered Monday?

So far, though, Michael Ferro’s career has proven out his ability to win investors’ confidence. We may soon see a new test in the bounds of that support.