Tronc's Adoption of Washington Post's Arc Platform Doubly Important

This week in Austin, Texas, at the zoo that the South by Southwest Interactive Festival can be, Washington Post Chief Information Officer Shailesh Prakash entertained a few of the digital animals. Prakash, the Post‘s executive in charge of both product and technology, highlighted his pet project, Arc Publishing, in his Tuesday “Predicting the Future of News” keynote.

Arc serves as the foundation for the reborn Washington Post‘s very digital-first publishing business. The platform, first developed in 2010, has helped drive the Post‘s astounding audience growth, maximizing the value of its expanding content to propel it from 50 million to about 100 million unique visitors in the space of two years. That’s the potential power of Arc. It’s a force multiplier for news publishers aiming to wring more value from the content they produce.

The Arc story is significant, one answer to the question of how legacy news companies can harness the best tools of internet creation, distribution and sharing, like the newcomers such as BuzzFeed, Business Insider and Vice have shown themselves able to do.

Today, despite spending hundreds of millions of dollars on publishing technology, many publishers’ news tech looks like a digital tower, or stack, of Babel. Legacy content production suppliers such as DTI and CCI have built out their digital capabilities atop legacy tech. WordPress and Adobe (ADBE) have become more of a standard among some publishers. And many companies, like Tronc (TRNC) have devoted countless resources of time and money to building, rebuilding and adding onto to their own proprietary systems.

All these systems require lots of integration with third-party software players, providing utilities publishers now find essential. Yet despite all the investment, most publishers will frankly, if confidentially, tell you that they find themselves falling further and further behind in the tech race.

Arc, now a platform available for license from the Post, creates a new “build or buy” decision for news publishers.

That makes Arc doubly notable. This week, as Tronc (nee Tribune Publishing) adopted Arc as its fundamental platform throughout its nine-city metro chain, Arc comes of age and gains what is now its biggest client.

Further, Tronc’s outsourcing soon reveals an apparent and distinct change in that company’s announced tech strategy, and one that other dailies, and chains of dailies, may consider sooner than later.

While one year ago Tronc was touting the tech chops of its new investor, Nant Capital chairman Patrick Soon-Shiong — including “100 machine vision and artificial intelligence technology patents for news media applications as well as access to and use of studio space made available by NantStudio” — it now plans to rely on another company for the foundation of its tech future.

Further, Soon-Shiong, whose recent, rapid accumulation of Tronc shares has made him the company’s second-largest shareholder with a 15% stake, became a smaller part of Tronc’s future this week. In an SEC filing, Soon-Shiong’s name was left off the company’s board slate, and his vice chairmanship will end in April. That’s a likely sign of chairman Michael Ferro’s even-greater control of the company, as Ferro looks for acquisition targets.

Tronc’s overall size puts it in third place among newspaper chains, and its flagship Los Angeles Times houses the nation’s fourth-largest newspaper-based newsroom. The Times aims to fully implement Arc within the year, and over that time other Tronc papers — first the larger such as the Chicago Tribune and then the smaller — are being scheduled to adopt it. Why is the L.A. Times first? For one thing, it drives about 60% of Tronc’s overall traffic, and a lot of its digital revenue.

Tronc represents both a challenge for Arc and a newfound ability for the platform to demonstrate that it can handle complexity.

“They run publications across multiple markets,” explained Matt Monahan, senior product manager at the Post. “That’ll be one thing that we haven’t encountered before. And then, they’re like us at the Post. They run a large newsroom with a bunch of journalists, they have a large technology team we’ll be working with, and, of course, they have a huge online readership.”

Monahan, reporting to Prakash, has been the Post‘s point man in many of the negotiations that have led to its roster of almost 20 clients.

Those clients range from the national, such as Canada’s Globe and Mail, to the global, including Latin America’s fast-growing digital-only publication, Infobae. Further, student papers and higher-profile weeklies, such as Portland’s Willamette Week, both earlier adopters and testers, continue with the product.

Given the L.A. Times‘ complexity, its Arc implementation will take most of the year to put into place. At the Times, and throughout Tronc over time, Arc will integrate with Tronc’s own editing tool, Snap, which itself is in the process of rolling out across Tronc newsrooms.

The overall Arc rollout will sport lots of moving parts.

“A lot of the work that we’ll do in launching at the L.A. Times will wind up getting us some progress against Chicago and Baltimore and some of their other papers too,” Monahan said. “But it’s definitely true that the kind of first-year focus in terms of milestones will be the L.A. Times.”

Tronc plans on using many of Arc’s capabilities offered through its dozen modules. One big question now in front of new TroncX (digital business) President Tim Knight is what Tronc will build atop Arc. How will Ferro’s expansive digital transformation now play out, given them groundbreaking agreement?

Tronc declined to make someone on the Arc project available for public comment on the initiative. Knight, a financial source said, already is making changes in his top management team, as Tronc gets its product and tech ducks in a row.

It makes sense that Tronc will expend its own direct resources on projects such as Backbone, its internal data project. The company described that evolving project on its February earnings call: “We now collect, analyze and take action on nearly 3 billion first-party data points per month. These data points provide a more sophisticated analysis for our audience, traffic and head monetization opportunities.”

If well-thought-through and -executed, a build-atop-Arc strategy could pay major dividends, allowing Tronc to maximize its own investment.

As a powerful platform, Arc offers many more capabilities than most publishers are prepared to use.

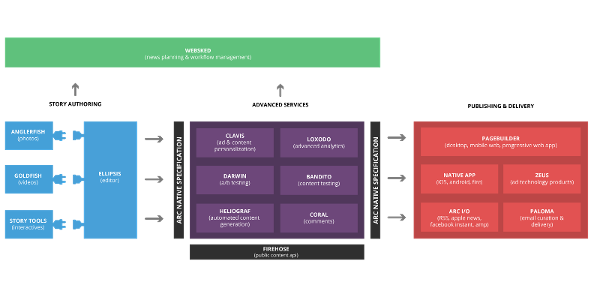

The chart below shows the latest iteration of the Arc platform. Story authoring (in blue) aims to streamline the content creation process and assumes a built-from-scratch multimedia product.

Publishing and delivery (in red) acknowledges the multinodal distribution reality of 2017. It incorporates native app workflow, social and search distribution and the increasingly vital business of newsletter building and delivery. That newsletter strategy — now producing 70 separate newsletters — has driven lots of the Post‘s own growth through Arc’s Paloma module.

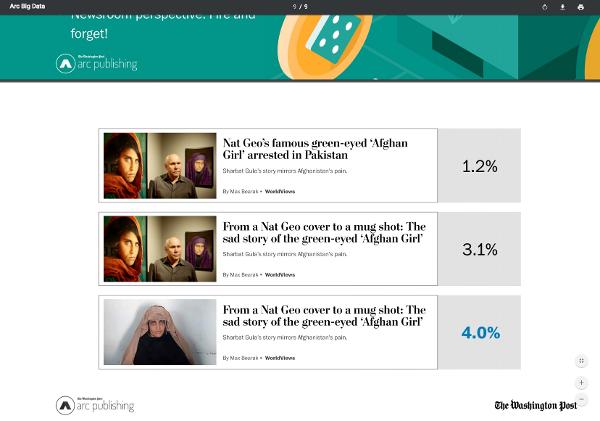

Advanced services (in purple) offers higher-level value. Loxodo, an analytics module, matches up with the kind of testing (Darwin and Bandito) that has helped the Post put up its big numbers. A recent visit to the Post revealed Bandito’s real-time headline testing, shown below, which produced 18 quite similar headline-and-art treatments — and as much as a 4% difference in page traffic, with a single word affecting clickability. The Clavis module dips publishers’ toes into personalization.

Publishers can license all the Arc modules or a subset of them. One selling point: the Post‘s big brother, Amazon (AMZN) , founded of course by newspaper owner Jeff Bezos. Arc is cloud-based, not an installed set of software, meaning both centralization at the Post of its operation and the promise of fast-to-market development. Amazon Web Services provides the hosting of Arc.

Publishers can license all the Arc modules or a subset of them. One selling point: the Post‘s big brother, Amazon (AMZN) , founded of course by newspaper owner Jeff Bezos. Arc is cloud-based, not an installed set of software, meaning both centralization at the Post of its operation and the promise of fast-to-market development. Amazon Web Services provides the hosting of Arc.

Does that Amazon connection comfort or worry publishers? So far, it’s more the former.

Few worry that Arc could be a stealth Bezos take-over-the-publishing-world project, a long game that starts with tech licensing.

So far, there’s little sign of the Post wanting to connect Arc to wider advertising network businesses, or other propositions in which it could leverage revenue shares of other publishers’ businesses.

Instead, publishers, marketers and editors have found appeal in Arc’s Amazon-like thinking: Concentrate above all on user experience and then connect and simplify to improve and extend that experience over time, making more and more money from those fruits.

Although Arc is supported and funded by Bezos, the “Jeff” whose name pops up regularly in conversation with Post executives, it is Prakash who has been Arc’s prime architect and mover. What Arc licensing does — at a basic level — is feed Prakash’s tech-building resources.

Arc clients’ main fees are usage-based, and they may pay as much as $2 million a year in revenue, though most of the earlier agreements are far smaller. The increasing revenue helps pay for Arc’s own 35 staffers, who operate the expanding business. As revenue increases, the Post‘s core engineering resources grow. That helps build out the system, adding, improving and integrating the work-together modules that make up the whole Arc — and increasing the value of Post-owned technology as well.

For the Arc publishers reached for this article, the Post‘s longer-term strategy is an academic concern. Their focus: getting better tech faster and reducing their vendor management and integration.

Publishing technology has served as just one of spirits bedeviling news publishing for two decades now. Publishers, large and small, have spent hundreds of millions of dollars building editing and production systems and almost always found themselves two steps behind what their audiences and markets needed. Facebook extensions. Reader testing tools. Data science integrations that connected their ad-serving business knowledge with their audience usage. And much more.

Arc customers give the product good reviews.

“It’s been a game-changer,” InfoBae product director Pablo Mancini said Wednesday. Buenos Aires-based Infobae aims to become the dominant Spanish-language news medium throughout the Spanish-speaking world, battling with legacy publishers such as Spain’s El Pais, Argentina’s Clarin and Colombia’s El Tiempo. Mancini said the 15-year-old Infobae has grown its digital audience by 50%, according to Google Analytics — to 34 million unique visitors — in the nine months since it began using Arc.

“It changes the way you work,” he said. “It makes us into a single team working together.” Mancini said Infobae’s 100 journalists can more quickly produce content, including graphics, maps and videos for the site.

First adopting the basic Arc platform, Infobae has just added on its Clavis (business intelligence) and Bandito modules.

Make no mistake, though. Arc is still a work in progress, both in its tech and in its business formation. The Tronc deal, though, certifies that it has moved to a next step. As Monahan put it: “We have some good success metrics coming back. We progressed beyond an experiment, when it started with universities and small papers, to something a little bit bigger.”