Weekend News Readers Phone It In – By The Millions: What It Means That Two-Thirds of Weekend News Consumption Happens On A Mobile Device

Consider it one more step in the evolution of the desktop computer into an archival paperweight.

New data shows newsreaders’ use of desktops dips dramatically as soon as they leave their 20-pound work units, and head home for the weekend.

About two-thirds of weekend news reading now is done on smartphones and tablets, according to new research from Parsely, a leading analytics company tracking more than 700 of the higher trafficked news sites.

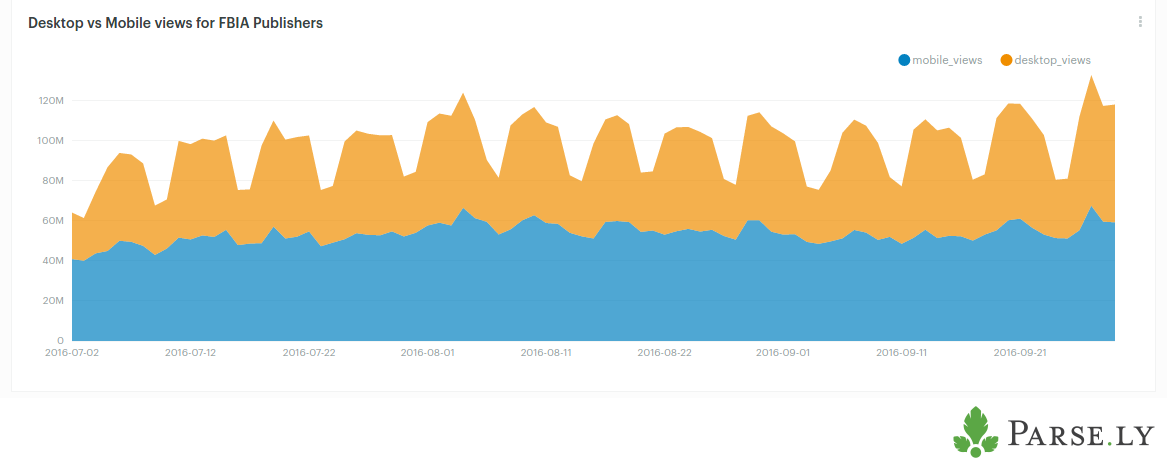

Those deep troughs you see in the chart above correspond to weekends, when desktop reading plummets and mobile reading stays fairly steady.

During the workweek, there’s one desktop newsreader for every mobile news reader. On weekends, there are two mobile readers for every desktop reader.

Another way of looking at it: “Desktop usage has ‘work-week’ peak times, whereas mobile usage is steady through the week,” Andrew Montalenti, Parsely’s CTO and a co-founder, told me.

This chart tracks U.S. usage from early July through the end of September. Montalenti said the weekend trough is one he has observed increasing over the last couple of years.

First published at POLITICO Media on Dec. 14, 2016

Follow Newsonomics on Twitter @kdoctor

That’s why this data is so significant – and potentially useful.

Mobile – treated as the little toe of publishing not too long ago – now is becoming the Internet, for audiences and advertisers. Those publishers who have invested resources to create state-of-the-art mobile products have positioned themselves to get at least some of the new pie; those that haven’t see their business fortunes further plummet.

The data offers one more nail in the coffin of the desktop computer as the main point of digital access. In early fall, we saw the quick advertiser reckoning of this fundamental change in device usage – in the works for almost a decade, but now at a tipping point.

In September, the Zenith Advertising Expenditure Forecast announced the first downturn in desktop ads. It forecast a drop of 0.8% this year, followed by deeper declines of 2.9% in 2017 and of 7.4% in 2018. You may remember some of the headlines following the report: “Zenith: Mobile Growth Will Cause Desktop Ad Spend To Decline Faster Than Print.”

In the couple of months since, print ad revenues have countered that too-early pronouncement. Third-quarter financial announcements spelled print ad disaster. The Wall Street Journal saw a 21% decrease in print. The New York Times reported print ad revenues down by 18.5%, followed by McClatchy, reporting a 16.9% drop, Gannett at 14.85% and Tronc–Tribune Publishing down 10.9%. Time Inc. was down 10%. Self – the first Condé Nast magazine to drop print and go digital – had been down 32% in ad revenue year over year.

In fact, it’s a combination of print ad losses and desktop downturn that makes life even tougher for most news and magazine companies. For the most part, they monetize their mobile readers less well than their desktop readers, still looking for the right ad formats, selling techniques and pricing to optimize smartphone ad pricing. That’s especially true for regional news publishers, where mobile ad rates can be as little as one-third those of desktop rates.

Few publishers have figured out how to target these more-mobile-friendly weekend customers. One of them is the Financial Times, long a student of its own data. In addition to transitioning to sell “audience” – across print, desktop, tablet and smartphone – the FT acted on its evolving business intelligence. Within that data, a couple of years ago, the FT noted a high usage of arts and weekend lifestyle content specifically on the tablet and smartphone on Sundays – that really lean-back day.

That led the FT to create a tablet-specific FT Weekend product and price it at an additional $99 pounds per year.

The pitch: “Enjoy FT Weekend wherever you are. Enjoy our superb lifestyle content wherever you are, with the new FT Weekend App Edition. With unlimited access through your tablet and smartphone, you’ll enjoy the weekend’s richest read – from the best in global arts and culture, to designer homes and distinctive travel. Subscribe now for just $99. Subscribe now and download the app to get full access to FT Weekend content, updating every Saturday to the new edition. The FT Weekend App Edition is available through your trusted Financial Times app.” (FT subscribers get the product as part of their overall digital subscriptions.)

The FT considers the product a small winner, both in obtaining new revenue and helping retain current subscribers. With its engagement metrics all-important, the FT has proven to itself that the product correlates with real revenue: “We know that weekend readership is a key contributor to engagement – users who read weekend content are more likely to be engaged than those who don’t.”

Recent Comscore research makes the same mobile-first point, using different data. While the Parsely data tracks monetizable page views, recent research from Comscore tracks usage by minutes. In a recent finding, Comscore found that two out of three digital media minutes are spent on mobile.

If mobile equals smartphone plus tablet, it is the smartphone that’s grabbing our attention . Through June, Comscore has reported 56% of all digital minutes can be attributed to smartphones, up from 50% just one year earlier. Tablets drive 11% of all digital minutes, down from 10% in 2015. One reason: bigger smartphones. “Large-screen smartphones now take significant time from tablet usage, down 17% or more in each age cohort.”

Importantly – for everything from product development to advertising emphasis – as I’ve reported earlier, that time is spent disproportionately on apps, not in the browser. “Mobile apps are approaching 60% of total digital time spent,” reported Comscore in its 2016 U.S. Mobile App Report.

It is, though, “computers” that are the big losers. Desktop now claims 33% of all minutes, down from 38% in June, 2015.

Usage is one thing. Publisher revenue is another.

In a November report, the Interactive Advertising Bureau reported that mobile advertising had almost doubled year over year for the first half of 2016. At $15.5 billion, as compared to $8.2 billion a year earlier, it showed an astounding 89% growth. Now, mobile advertising accounts for 47% of all digital ad spending – up from just 30% a year ago.

It is Google and Facebook – both of whom prepared well for this mobile transformation ahead of their lesser-resourced and slower-moving competitors – who disproportionately benefit from the mobile tilt.

Parsely’s Montalenti noted that Facebook has titled strongly toward mobile in the last several years. Its publisher programs – like Instant Articles – can benefit doubly as mobile news reading increases. “In this light, one could also view the FBIA effort as a way to own a larger share of weekend traffic,” he said.